Published 2024-10-07 00:15 EDT

I just got back from a two-week trip to Mumbai, Pune and Delhi. Every time I go to India, I'm amazed at how much things have changed in such a short time yet how things just stay the same. Billions of dollars are being spent on infrastructure across the country. Highways, high-speed rail systems, airports, space exploration, solar and water filtration plants, etc. One of the oldest (if not the oldest) civilizations on the planet is in the process of experiencing the industrial revolution, the knowledge revolution and the services revolution all at the same time. If China became the manufacturer for the world, India is poised to be the service provider to the world.

"India definitely remains the service economy of the world and it's gained a component of manufacturing as well".-Filippo Gori, co-head of global banking at JPMorgan

When I first moved to India in 2007, it's almost as if the word "startup" was a dirty word in the tech world. No one wanted to work at a startup. If one couldn't get a job at a multinational corporation like Goldman Sachs, Microsoft or Google, then they looked for a job at a startup or at small dev shop. One person I was interviewing brought their parent to the interview. It turned into the parent interviewing me instead of me interviewing the candidate. There's plenty of stories of relationships, arranged marriages, etc falling apart because one of the couple was working at a startup.

Today, things are quite different, even with the layoffs and downturn in funding from 2022 to today. Recent CS grads are fighting to get into the hottest startups and unicorns. One must stop and wonder why this massive shift happened in less than a decade.

I have a few thoughts on this.

- Macro conditions including th epivot away from China have benefitted India. Median age, privitazation, opening up industries to foreign investment, governmental digital infrastructure innovation and other policy shifts have accelerated domestic growth.

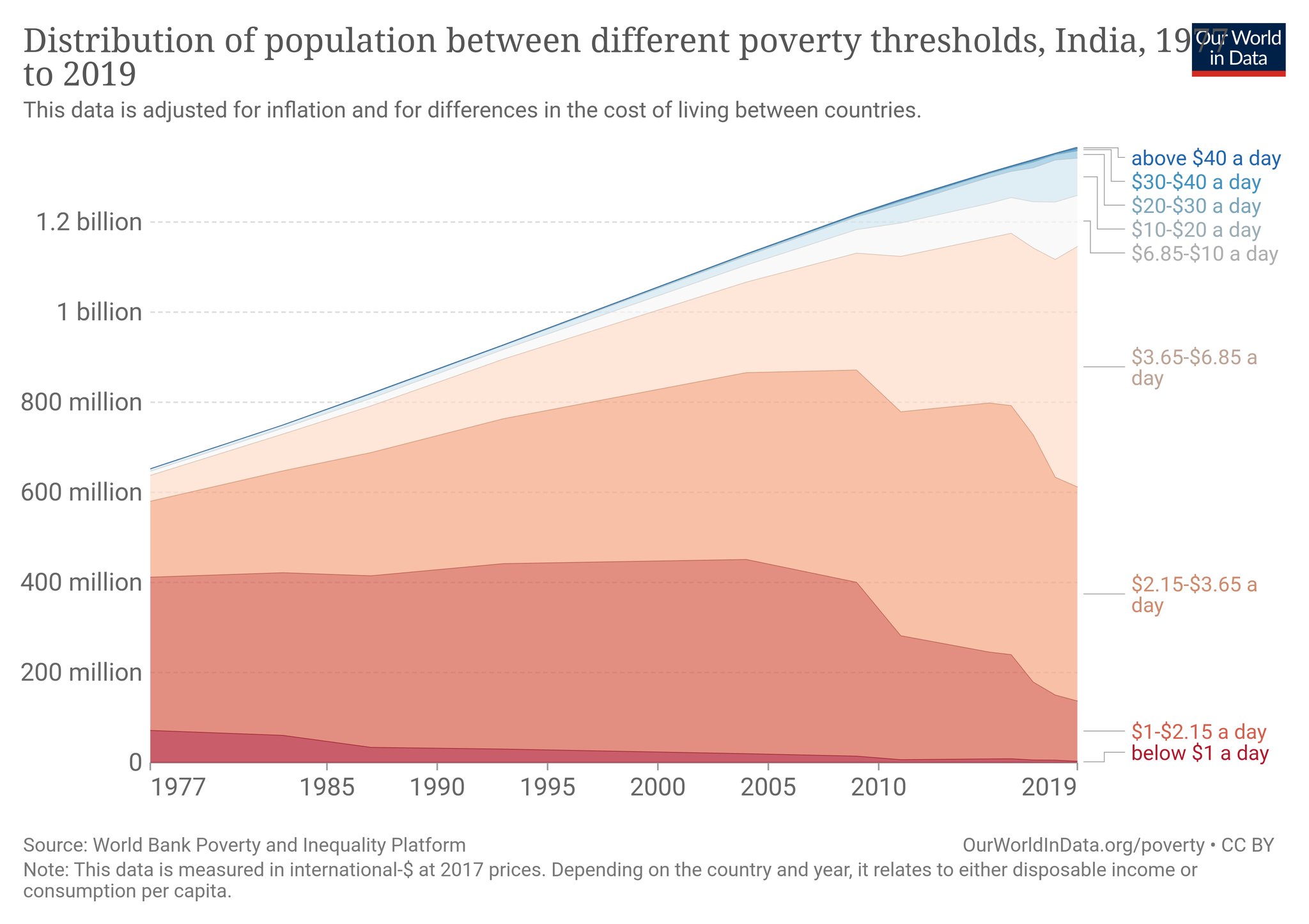

- To me, one of the most important factors has been the

deep reduction in extreme poverty in India. Though a lot

of work remains to be done, organizations like

The Nudge

Institute are taking innovative approaches to

supporting non-governmental initiatives to eliminate

extreme poverty.

- Salaries are better than in traditional businesses or other multinationals (Thank you VCs).

- The amount of marketing startups have done on TV, online, in newspapers and magazines has helped them to achieve unprecedented brand recall

- The Prime Minister has made tech a cornerstone of India's progress. From selfies with world leaders to more than fiteen billion digital transactions per month to a mission to the South Pole of the Moon, tech is increasingly seen as a means for individuals and the country to prosper.

- The first batch of tech IPOs were unleashed in 2021. In 2023, the second highest number of IPOs in the world took place in India. I would argue that valuations of Indian stocks are reminiscent of the dot.com era in the US but macro and sector growth rates in India are far greater than the late 90s in the US. The success of the Indian IPO market over the last few years has captured the attention of multiple generations of Indians. Millenials and GenZ in India continue to increase the amount of their savings invested into the stock market either directly or indirectly via mutual funds or ETFs. Opening a Fixed Deposit or Certificate of Deposit is no longer the preferred method of saving as it once was. This has also attracted more talent in the tech sector since many of the people are investing in new-age Indian tech stocks now. Does this remind you of anything?

- Indian conglomerates like Reliance JIO are actively investing in technology while also buying tech companies and investing in startups. This has provided additional validation to the tech narrative across India.

In September, I met many founders including an incredible young founder named Rushabh who is building hardware and software solutions to reduce infant mortality and illnesses like dehydration and UTIs. At the other end of the spectrum, I met founders building AI video editing solutions for social media creators. There is a lot in between as well. Founders are building solutions for Bharat but they are more aggressively building businesses targeting the US and other global markets. AI solutions for the enterprise, fintech products targeting small and medium sized businesses across the US and so many many more.

I've been saying this for a long time - there's an incredible amount of optimism for the future. When you're traveling around India, you can feel it in the air. At the same time, however, there's an element of irrational exuberance. The stock market is a good example of this but so is the venture ecosystem. Deals are taking longer to get done but valuations are back up and I could argue that in many cases, they are just plain silly. This is a typical supply and demand mismatch. There's an abundance of capital but not enough high growth companies to deploy into. This company has eith employees, two showrooms and their IPO was oversubscribed 400x.

It's no longer in anyone's economic interest to ignore India and what's happening there. Whether one is investing there or not, one does need to pay attention to what is happening on the economic and technology side. Jamie Dimon, CEO of JPMorgan says, "I think the optimism of India is actually completely justified".

In a recently published research brief by Morgan Stanley, the author, Pamela Fung, wrote "For the last decade, early-stage VC valuations have generally hovered at 20-50% of the levels of the U.S. This appears reasonable particularly given the strong growth trajectory and capital efficient nature of the businesses. For late-stage VC valuations, where global investors are more likely to participate, the differential is somewhat smaller, but the spread persists. This is in comparison to the China VC market, which at its peak traded close to U.S. VC valuations."

There are sitll, plenty of challenges. India's young population has been a big driver of growth. However, India needs physical and digital infrastructure to support this continued growth. Affordable educational opportunities to help make young people globally employable is still a major challenge as well. For all of India's advancements, poverty is everywhere. In 2023, according to the World Bank, India's GDP per capita was $2,484 while China's was $12,614. The US was at $81,695. There's a lot of opportunity in building 21st Century Bharat!

Dont' forget to check out Chamath's Deep Dive on India.

Deep Dive: Is India the Next Economic Giant?

— Chamath Palihapitiya (@chamath) October 1, 2024

Around 20 years ago, China experienced a period of unprecedented economic growth and technological advancement. I watched many of my friends invest early in China and achieve remarkable success.

Yet, I didn't make a single investment… pic.twitter.com/KLVFYWgy6v